Kisan Credit card Apply online, Check Status,Benefits, PM kcc online, loan,Helpline, Rate of Interest

The Government Of India Has Launched Kcc Kisan Credit Card Scheme for all the Farmers of India, Through the Kisan Credit Card the Farmer Can Withdraw Up To 3Lakhs From Kisan Credit Card Kkc Card At A Very Low Rate Of Interest. Kisan Credit Card Scheme’s Main Objective To Protect The Farmer From The Clutches Of Moneylenders. Kisan Credit Can Be Used For Buying Agricultural Equipment And Farming-Related Goods. Farmer Can Use 10% Of The Total Sum On Domestic Use And The Rest Of The Money Shall Be Used For Farming-Related Uses Only.

What is KCC Kisan Credit Card Yojana?

Modi Government Has Launched The Scheme Under Self-Reliant India(Aatamnirbhar Bharat), More Than 9.7Crore People Register For Kisan Credit Card, About 8.4 Crore Are Benefited From The Scheme. The Central Government Has Directly Transferred Money To The Banks. Kisan Credit Card Has An Active User Of About 6.67Cores.

The Government Of India has proclaimed To Include The Farmer In The Upcoming Few Years. The Farmer Can Avail benefits Scheme By Applying For The Kcc Card.

Required Documents To Apply For Kisan Credit Card:

The Documents Required For The Kisan Credit Card Are As Follows:

- Aadhaar Card(Proof Of Address And Photo Identity)

- Ration

- Pan Card

- Active Mobile Number

- Passport Size Photo Of Beneficiary

- An Affidavit Stating That A Loan From Any Other Bank Is Not Given, Till February 2021

Eligibility For Kcc Kisan Credit Card

- Should Not Be Above The Age Of 70 Years

- Applicant Age 60 Required Co-Applicant(Compulsory)

- Must Be A Permanent Resident Of India

- Farmar Should Have Cultivatable Land

- Individual Involved In Farming And Agricultural Activities

- Tenet Farmers, Sharecropper Of The Cultivatable Land

How Apply Online For The Kcc Kisan Credit Card?

Step1:Goto To The Official Website Of Kcc Kisan Credit Card i.e pmkisan.gov.in

Step2:Now On The Lefthand Menu, Click On The Download Kcc Application Form pdf

Step3:Now, The Application Form Will Be Downloaded

Step4:Take A Printout And Fill The Application Form

Step5:Now You Can Submit The Application Form To The Nearest Bank

Step6:Within 15 Days Your Credit Card Will Be Issued

Which banks are offering Kcc Kisan Credit Card?

| State Bank of India |

| Punjab National Bank |

| Bank of Baroda |

| ICICI Bank |

| Allahabad Bank |

| Andhra Bank |

| Sarva Haryana Gramin Bank |

| Canara Bank |

| Odisha Gramya Bank |

| Bank of Maharashtra |

| HDFC Bank |

| Axis Bank |

How Apply For Kcc Kisan Credit Card Through Banks Website?

Step1:Go to the official website of the bank you wish to get a credit card you can check the bank list here

Step2:Click on the KCC form

Step3:Fill the application form

Step4:Click on submit button

Step5:now the reference number will be displayed on the screen

Step6:Note the reference number in order to check application status later

Application Form Kcc Kisan Credit Card Bank Wise

| Bank Name | Kcc Bank Application |

| State Bank of India | Click Here |

| Punjab National Bank | Click Here |

| Bank of Baroda | Click Here |

| ICICI Bank | Click Here |

| Allahabad Bank | Click Here |

| Andhra Bank | Click Here |

| Sarva Haryana Gramin Bank | Click Here |

| Canara Bank | Click Here |

| Odisha Gramya Bank | Click Here |

| Bank of Maharashtra | Click Here |

| HDFC Bank | Click Here |

| Axis Bank | Click Here |

Kisan Credit Card Validity

Kisan Credit card is valid for 5 years after that the Farmers has either apply for New card or Renew the Old card. one farmer can Apply for 1 card only applying for multiple cards will be considered as fraud

Kisan Credit Card Rate Of Interest

The Farmers Are Given A Loan Of 3 Lakhs Under The Kisan Credit Card.

There Is An Interest Rate Of 9% On The Loan Without Any Guarantee

On The Kisan Credit Card, There Is A Subsidy Of 2% From The Government Of India,

The Farmers Will Have To Pay Only 7% Interest, But If The Farmer Tilts The Loan Before The Deadline, Then He Gets A Rebate Of 3%.that means farmer’s has to only pay 4% interest only

Benefits of KCC Kisan credit card yojana

- Personal Accident Insurance Scheme (PAIS) for the borrower

- Eligible crops insurance under PRADHAN MANTRI FASAL BIMA YOJNA (PMFBY).

- if the card is activated once in 45 days, Accidental insurance of Rs.1.00 lakh for Rupay Cards holder

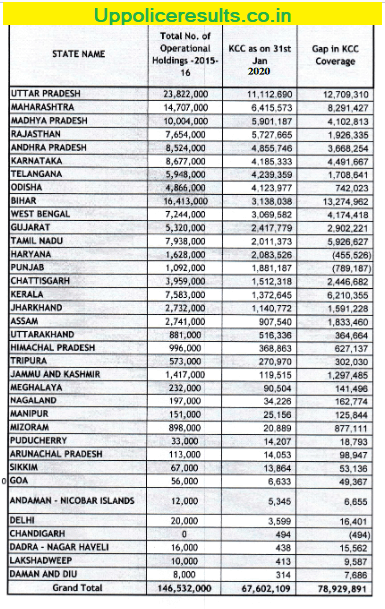

Active user of Kcc Statewise

Kisan Credit Card Helpline

Call Center:1551

Toll-Free Number: 1800-180-1551

Also Read: Uttar Pradesh Caste Certificate Status, Online Verification and Apply Online 2021